New research by Eagle Hill Consulting affirmed some expected demographic trends and uncovered a surprising one. As you might expect, the study found that Millennials are four times more likely than those 55 and older to prioritize viewing convenience over viewing quality. What you might not assume? Those who responded as non-white are nearly twice as likely as those who responded as white to do the same. Meanwhile, Millennials are almost 20 times more likely than those 55+ to watch TV on the go.

Eagle Hill’s findings suggest that key trends have already moved farther and faster than you might think. The result is a chasm between quality and convenience—and a pressing question for every TV executive: How and where do you invest when you’re serving multiple segments with diverse habits and preferences?

Millennials > Baby boomers

Pew Research Center reports that Millennials have surpassed Baby Boomers as the nation’s largest living generation, with those ages 18-34 numbering 75.4 million in 2015 compared to 74.9 million Baby Boomers (ages 51-69). While most Baby Boomers still prefer a traditional, quality-focused viewing experience, Millennials are more likely to value convenience. In fact, convenience is four times more important for viewers 18-34 than for those 55 and older.

Booming diversity

Eagle Hill’s study found that across all ages, nearly twice as many of those who responded as non-white (36% vs. 20%) prioritize convenience over quality. That has major implications as the nation’s population becomes increasingly diverse. Another Pew Research Center report predicts that by mid-century, the United States will have no racial or ethnic majority group. Instead, we will have a “minority majority”—with whites making up less than half of the population.

Nearly twice as many of those who responded as non-white (36% vs. 20%) prioritize convenience over quality.

On the couch or on the move?

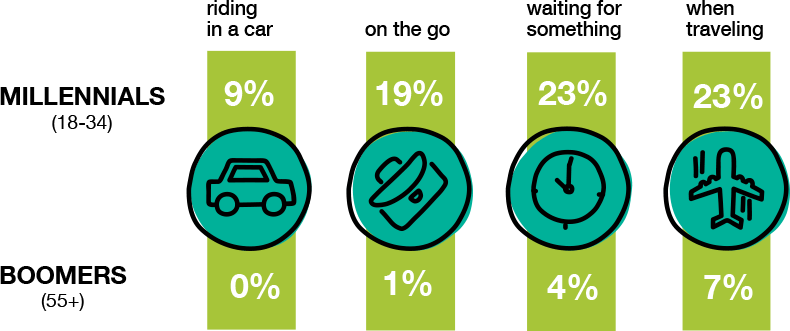

For nearly 90% of all respondents, home remains the most popular place to watch TV (see Figure 2). But compared to their parents, Millennials are nearly 20 times more likely to watch TV on the go (see Figure 1).

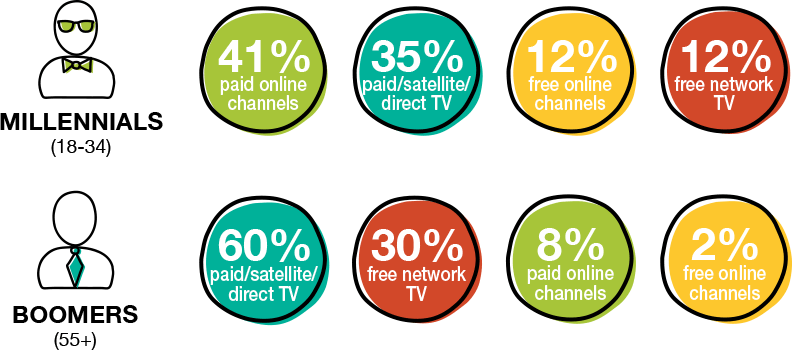

Millennials are also comfortable cutting the cord, with more than half (53%) reporting they most frequently watch online channels. Just 10% of those 55+ say that’s their top TV service (see Figure 3).

FIGURE 1. DIFFERENCES ON WHERE MILLENNIALS AND BOOMERS WATCH TV

Source: Eagle Hill Next Generation TV Survey, July 2017

FIGURE 2. WHERE MILLENNIALS AND BOOMERS ARE BOTH WATCHING TV

Source: Eagle Hill Next Generation TV Survey, July 2017

FIGURE 3. CONTENT QUEST: WHAT PEOPLE WATCH MOST FREQUENTLY

Source: Eagle Hill Next Generation TV Survey, July 2017

Why it matters

Nielsen research shows that average time per day watching video keeps increasing, yet traditional TV consumption continues to decrease. What are the right investments when you’re serving multiple audiences with diverse habits and preferences? Don’t choose convenience over quality or quality at the expense of convenience. Find a way to straddle both—making investments that will pay off now and as trends evolve and accelerate.

Straddle the chasm

- Get nimble–and start by putting your house in order

You don’t need all the answers to act, and you don’t have to start with a big bang. No matter where you are today, begin by getting your house in order: Examine current workflows. Weed out duplicative processes. Find opportunities to simplify, consolidate and virtualize your infrastructure. Making your operations more efficient means you have more resources to devote to content—and positions your organization for growth. - Shift your business model

Still thinking of your organization as a broadcast, online and/or wholesaling business? Truth is, you’re in the content business. Your organizational culture needs to evolve to reflect that. Encourage people to think in new ways, embrace and manage change, ask tough questions and tackle complex problems. - Think about how you’re serving segments

Content is no longer a mass-market business. With diverse audiences, growing competition and an abundance of brands, content looks more like a consumer business. As you shape your organization, look to consumer industries for lessons in understanding and building relationships with customers. One possibility: appointing a Chief Segment Officer responsible for analyzing each segment’s needs and helping to craft the kind of viewer experience that delivers both quality AND convenience.

Methodology

The survey included 1,007 interviews across the US adult population. The survey polled respondents on national TV trends and preferences. Survey respondents were asked to self-select their race. The Eagle Hill Next Generation TV survey was conducted by Ipsos in July 2017.