Are financial services companies doing enough to enable their employees’ full potential through technology? More than one in three U.S. employees are frustrated with their technology at work every day, according to new research from Eagle Hill Consulting. Moreover, less than half say that their organization places high importance on deploying technologies intended to make their jobs easier. Instead, one in five employees thinks that technology makes their job harder.

Eagle Hill surveyed 505 financial services employees in the U.S. to gauge their attitudes toward technology deployments in their companies and assess the overall impact of technology on the employee experience (EX). On one hand, a positive EX can speed the adoption of new technology, so that organizations realize business outcomes like productivity and shareholder value faster. On the other hand, negative EX often leads to frustration, which can become so entrenched that it jeopardizes full technology adoption and business outcomes—and erodes ROI over time.

Key Findings: What we found

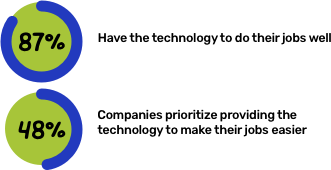

1. Technology helps employees do their jobs well—but it can make their jobs harder

A full 87% of financial services employees surveyed say they have the technology to do their jobs well. However, only 48% say their companies prioritize providing the technology to make their jobs easier. And many say technology actually makes their jobs harder.

Source: Eagle Hill Consulting Employee Experience Survey 2021

2. Employees’ challenges with technology impact the financial services customer experience

Almost one-fifth (18%) of financial services employees say technology either doesn’t help or makes it harder to serve customers—both internal and external. This has enormous implications for organizations’ customer experience (CX) strategy both in how they service customers via technology and drive customer-centricity.

Source: Eagle Hill Consulting Employee Experience Survey 2021

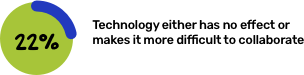

3. Technology is not always making it easier for employees to collaborate

Twenty-two percent of financial services employees indicate that technology either has no effect or makes it more difficult to collaborate with colleagues. This is at a time when collaboration among knowledge workers is foundational to both EX and CX.

Source: Eagle Hill Consulting Employee Experience Survey 2021

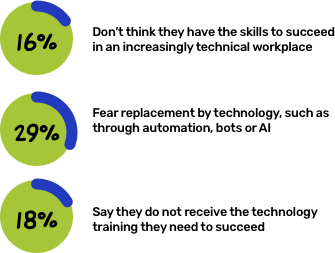

4. Employees say that they do not have the technology skills to succeed

Today, 16% of financial services employees don’t think they have the skills to succeed in an increasingly technical workplace. In fact, 29% fear replacement by technology, such as through automation, bots or AI. And 18% say they do not receive the technology training they need to succeed.

Source: Eagle Hill Consulting Employee Experience Survey 2021

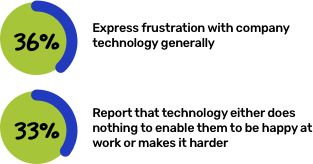

5. Financial services employees are frustrated with technology resources at work

A little over one-third (36%) of financial services employees express frustration with company technology generally. What’s more, 33% report that technology either does nothing to enable them to be happy at work or makes it harder.

Source: Eagle Hill Consulting Employee Experience Survey 2021

Why it matters

These findings reinforce that technology change is not primarily about technology. Maximizing ROI hinges on how well financial services employees embrace technology and incorporate it into their daily work to drive results. In essence, technology change is about changing employees’ entrenched behaviors to deliver business value.

While technology adoption methods—such as user experience, human-centered design, advanced training, and communications campaigns—are well understood and widely used, financial institutions often find them challenging to implement intentionally and holistically. Legacy infrastructure and organizational silos typical of most financial companies make doing this even harder. What’s more, technology change management initiatives are often isolated and episodic.

These approaches miss the fundamentals of successful technology adoption—continuously engaging and preparing employees, managing preconceptions, and equipping employees to work smarter with technology and derive more satisfaction from it. In short, a laser focus on ETX.

Financial services companies are investing in advanced technologies, but not in change enablement, which is key for employees to benefit fully from technology across satisfaction, engagement, and collaboration.

What to do next

Financial services companies need to take a more employee-centric approach to technology adoption to improve ETX. This includes change management fundamentals of communication, learning and development, as well as stakeholder and leadership engagement.

But more importantly, the approach should engender a culture of adoption alongside traditional go-live and use activities, emphasize the employee technology experience, and look to achieve greater business value across different user groups. Instead of one-off efforts to promote employee take-up (typically platform by platform), financial services companies should embrace ETX as part of their technology change repertoire.

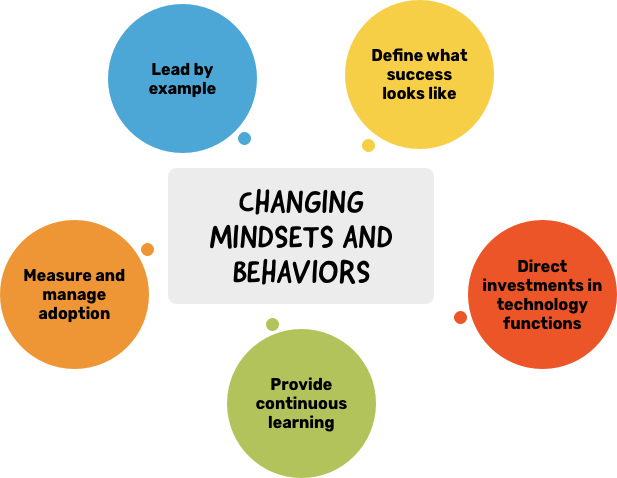

Here’s how to get started driving technology adoption and maximizing value:

Lead by example. Executives and other company leaders should be visibly active in modeling the desired behaviors related to technology use. Organizations can create momentum by ensuring that leadership is well equipped with consistent messages and clear actions. And not all leaders have to be in the corner office. Identify and enlist role models across levels and groups.

Define what success looks like. Organizations should go into any technology investment and implementation understanding what the technology represents for every stakeholder group. This means understanding current pain points across the customer lifecycle. It also involves understanding how functions and features could be used in a more beneficial way.

Direct investments in technology functions and features. Organizations should avoid making technology investments in a vacuum. It’s important to align them with the EX and CX strategies as well as the desired business processes. This requires understanding where technology is failing to deliver in these areas—and why. It also means understating how the technology can be used to facilitate business processes and what modifications are needed to support EX and CX.

Provide continuous learning beyond the classroom. People learn in many ways, and organizations should think outside the box to educate employees about new technologies. This applies to both the methods used and the focus of the learning. Both should be highly targeted to the employee audience and provide easy-to-understand guidance about how to maximize the technology’s capabilities. Enlisting super users across departments provides go-to resources for employees.

Measure and manage adoption and use. As with any investment, companies need the right metrics to understand whether they getting the maximum ROI from technology. As such, they should set up relevant KPIs around EX and CX and measure them. Together, consistent communications and incentive programs can build awareness and take-up. Leaders can use reports and dashboards to monitor adoption.

The more that financial services firms take action to improve ETX, the better positioned they are to enhance their business ROI.

Related services and insights

ChangeUncovering ROI: The hidden link between technology change and employee experience

Methodology

The Eagle Hill Consulting Financial Services Employee Experience Survey 2021 was conducted online by Ipsos in January 2021. The survey included 505 respondents from a random sample of financial services employees across the United States. The survey polled respondents on employee experience aspects, including technology, diversity, employee engagement, and customer service.