The Eagle Hill Consulting Employee Retention Index

October 2025 release

Uncover emerging trends. Anticipate shifts in retention. Keep your best people.

Employee Retention Index reaches unprecedented high, signaling workers will continue to remain in their jobs through first quarter of 2026

Employee loyalty is surging. The Retention Index makes its third consecutive gain, rising to a record high of 105.8. This upward trend signals that U.S. workers will continue to job hug and remain in their jobs over the next six months.

Most striking this period is a wave of strengthening employee sentiment across all four of the Retention Index’s indicators: Organizational Confidence, Culture, Compensation, and Job Market Opportunity. The Organizational Confidence indicator posts a record high, gaining 3.2 points to 104.7. Similarly, the Compensation indicator gains a record 6.5 points, reaching a historic high of 109.9. The Culture indicator climbed 2.4 points to 103.1, while the Job Market Opportunity indicator rose 5.8 points to 101.

Latest retention indicators

+2.9

Employee Retention Index

+3.2

Organizational Confidence

+2.4

Culture

+6.5

Compensation

+5.8

Job Market Opportunity

Key employee retention insights

The Employee Retention Index reveals a surging wave in U.S. employee sentiment and record workforce retention outlook. Yet, underlying the Index and indicators’ gains, segments of the workforce report variability and some pose potential attrition risks.

Millennial workers and women post significant Retention Index gains, 8.9 and 6.9 points respectively, and now sit at record highs, indicating each are more likely than ever to stay in their jobs over the next six months. They are also the only workforce demographics to experience increases across all four of the indicators. Conversely, the Retention Index declines among Gen X workers and men, down 4.7 and 0.8 points respectively, signaling they will be more inclined to leave in the months ahead.

Millennials emerge as the workforce segment most likely to stay, while Gen X poses the largest attrition risk for employers.

Organizational confidence insights

Organizational confidence reaches a record high this period, with the Organizational Confidence Indicator rising 3.2 points to 104.7. This milestone is driven by U.S. employees’ growing confidence in organizational leadership. Since late 2024, employees have been steadily reporting greater trust in their leaders’ ability to guide through uncertainty, even as employee confidence in their organization’s future has plateaued.

However, confidence trends are not uniform across the workforce. Women, Gen Z, and Millennial workers report meaningful gains in the Organizational Confidence Indicator, while men, Gen X, and Baby Boomers decline, highlighting a split in how different segments of the workforce view organizational stability and leadership strength.

While Gen X and Baby Boomers have held the weakest positions within the Organizational Confidence indicator three of the last four periods, Gen Z and Millennials have held the strongest. This pattern highlights an emerging generational divide: early-career employees express optimism and trust in organizational leadership and trajectory, while more experienced workers—particularly Gen X—remain more doubtful.

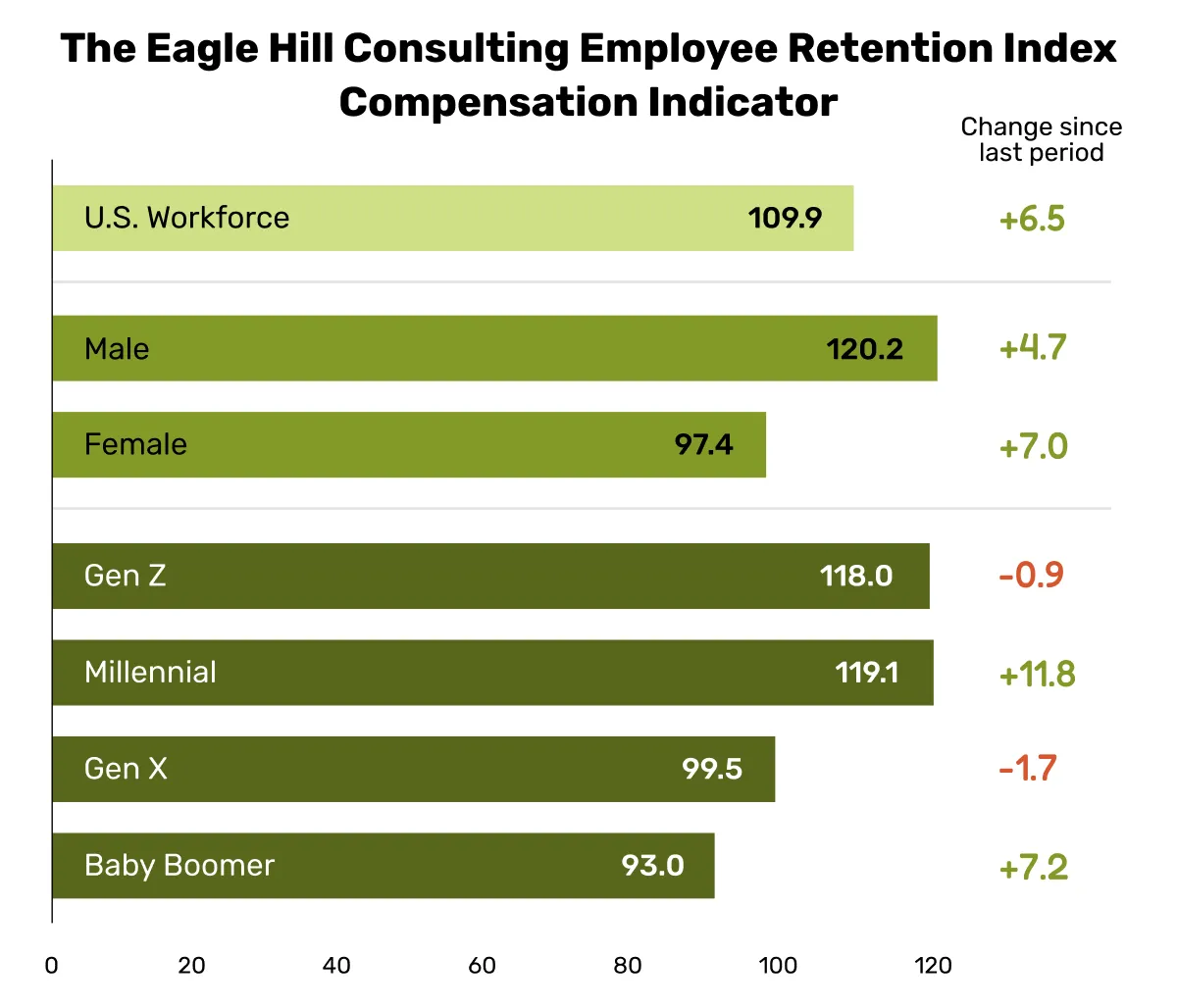

Compensation insights

The Compensation Indicator rises 6.5 points to 109.9, reaching a record high this period. The indicator’s upward trend has been steady throughout 2025 and this period’s record reflects increasing employee satisfaction with current pay and benefits, as well as growing optimism around future compensation potential within their organizations.

Millennials drive much of the surge, increasing 11.8 points, followed by Baby Boomers, with gains of 7.2 points. At the same time, Gen Z and Gen X employees report slight declines in compensation satisfaction.

While satisfaction with current and potential compensation has never been stronger across the workforce as a whole, disparities exist by gender and generation. Men report higher compensation satisfaction than women, continuing a long-standing gap in compensation sentiment, while earlier-careers workers report higher compensation satisfaction than their later-career counterparts.

Track. Assess. React.

The first of its kind, the Eagle Hill Consulting Employee Retention Index tracks quarterly sentiment of U.S. workers across four proven drivers of employee retention, which compose the Index’s indicators:

- Organizational Confidence: measures how confident employees are in their organization’s future and their organization’s leadership.

- Culture: measures how employees feel about their workplace culture, connections, feeling valued and recognized.

- Compensation: measures how employees view their compensation, benefits, and ability to grow their compensation at their organization.

- Job Market Opportunity: measures how employees perceive external prospects for employment and job security in the near term.

As the Employee Retention Index increases, it signals an increase in workforce retention in the next six months. As the Index decreases, it warns employers that workers are more likely to leave their jobs, and organizations can expect more turnover in the months ahead.

Methodology

The Index is based on a monthly omnibus survey conducted by IPSOS of a nationally representative sample of U.S. adults employed full or part time. Quarterly indices and reports are issued based on a minimum of 1,200 aggregated responses per quarter. Respondents are polled on a range of workforce topics including organizational confidence, culture, compensation, and job market opportunity.

Related resources

Unlock the power of your people with our insights and library of content designed to drive employee retention and engagement.